In addition to spot trading, Kraken users can also trade cryptocurrency using margin and execute crypto derivatives trading strategies. Kraken’s professional-grade trading platform, Kraken Pro, is our pick for the best low-fee exchange because it charges some of the lowest fees in the crypto asset exchange landscape. It’s also our top choice for experienced traders, as it offers advanced order types and supports margin and futures trading. The future of finance is pointing towards digital currency and blockchain technology, with cryptocurrencies becoming more widely accepted as a form of online payment. While they are currently volatile, they offer potential long-term investment opportunities and are gaining ground as powerful contenders in the financial landscape. It is recommended to start exploring the world of digital assets with a reputable cryptocurrency broker.

That said, a crypto broker can, in some cases, refer to a dedicated individual – such as an institutional trader – working on a trading desk. While the individual on the trading desk is helping to “broker” each trade, it’s important to note that they will almost always utilize underlying crypto exchanges to execute their trades. EToro offers access to the largest crypto coin selection of any company we cover in the online broker space, and it does this with one of the most user-friendly experiences in the industry. One login to eToro’s online brokerage platform gives users access to stock, ETF, and physical crypto coin trading, all on the company’s intuitive and socially focused web-based and mobile platforms. Coinbase is one of the best investment platforms for crypto trading, staking rewards, and crypto storage. The crypto exchange offering nearly 250 coins and tokens and is great for active real investors who can utilize Coinbase’s services, account options, and investment tools.

With the price of Bitcoin touching new all-time highs above $73,000 in March, it’s important to know which brokers may be best for you to analyze and invest in Bitcoin and other cryptocurrencies. A cryptocurrency exchange is like an online brokerage for cryptocurrencies, tokens (virtual assets created through existing blockchains), and other digital assets. Many of these exchanges offer investment options for active traders looking to buy, sell, or hold digital assets like bitcoin, ether, and litecoin. Some crypto exchanges support advanced trading features like margin accounts and futures trading, although these are less commonly available to U.S.-based users.

You can get started almost immediately with Robinhood’s instant transfer feature, so it’s just download and go. Kraken does not offer its service to residents of New York and Washington state. Tastytrade is a relatively newer player to the brokerage world, and it offers some attractive best cryptocurrency brokers pricing on cryptocurrency trades, which are enabled by partner Zero Hash. Tastytrade charges 1 percent of the trade value on the buy and sell, but only up to $10 per side of the trade. So once you’re trading more than $1,000, your crypto commissions here flatline at a sawbuck.

It is a Cyprus-based derivatives broker with multiple regulations, including by the FCA in the UK and FSC in Mauritius. The broker offers more than 1200 tradable instruments, including a dozen cryptocurrencies. Professional traders choose FXTM because of its superior execution performance coupled with below-average trading fees. And they can take advantage of both against an initial deposit of only $500. Check out our expert picks for some of the best cryptocurrency exchanges for 2024.

We highlight each broker’s strengths and weaknesses, explain regulatory details, and share the results of our live tests of brokers’ fees, customer support, and trading platforms. Founded in 1996, OANDA US is regulated by the CFTC/NFA and has global entities licensed by Tier-1 authorities. It offers access to forex, crypto, and metal markets from various feature-rich trading platforms. The broker’s cryptocurrency offering is rich as it provides access to 79 underlying crypto coins and 14 CFDs. CFD is a contract for differences, which means that you do not own the underlying asset.

On the other hand, if you’re looking to trade whatever is hot at the moment, consider an app or exchange with more variety. While cryptocurrency has surged in popularity in recent years, only a minority of Americans have actually traded it. Among the most popular cryptos are Bitcoin, Ethereum and Cardano, each of which has seen a lot of action as prices rise and fall. The potential to make significant money on the volatility of these highly speculative assets. You’ll also need to consider whether you want to trade more than Bitcoin, which is what the majority of traditional brokers restrict you to. If not, you may want to turn to a cryptocurrency exchange, since they offer more choice of tradable cryptocurrencies.

Use the broker comparison tool to compare over 150 different account features and fees. The main drawback of using Cash App to buy and store Bitcoin is that the in-app wallet is custodial, which means the company holds your virtual currency on your behalf. While custodial wallets can be convenient, they are also regarded as less secure than non-custodial wallets. However, since you can withdraw your Bitcoin from Cash App, you can move your cryptocurrency into a personal wallet to which you hold the private keys.

CNET staff — not advertisers, partners or business interests — determine how we review the products and services we cover. The SEC sued Coinbase in June 2023, alleging it had illegally operated as an exchange, broker-dealer and clearing agency, and offered and sold unregistered securities. The lawsuit said Coinbase knowingly violated securities laws that are designed to protect investors.

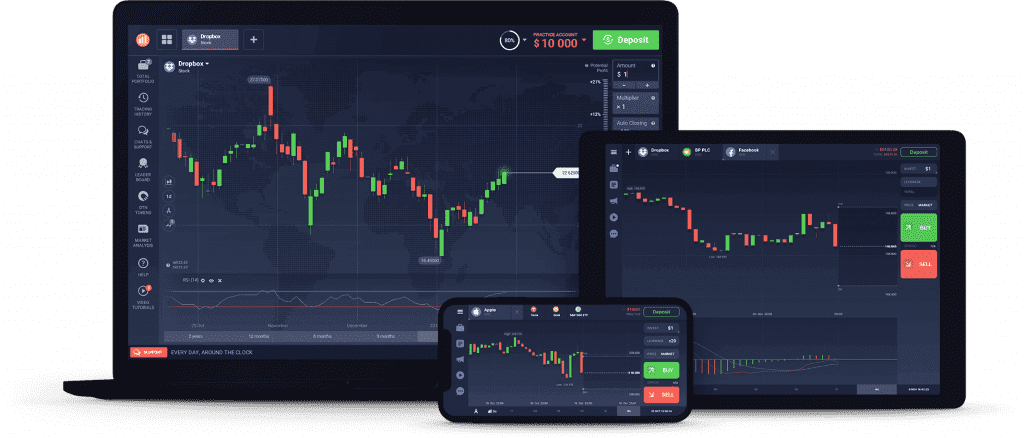

The best cryptocurrency exchanges work similarly to the best stock trading apps, offering competitive fees and resources on digital marketplaces like mobile or desktop. Crypto-enthusiasts can easily buy, sell, and store popular digital currencies like bitcoin or Ethereum alongside traditional investable securities. The crypto trading platform allows users to buy and sell digital assets, including Bitcoin, Ethereum, Solana, Cardano, and hundreds of other coins, at a nominal fee. While Coinbase is a crypto trading platform, it has several other features that make it one of the best cryptocurrency stocks to buy. Crypto trading refers to the buying and selling of cryptocurrencies, such as Bitcoin, ethereum, or Ripple, on various cryptocurrency exchanges.

The term “exchange” may refer to a variety of cryptocurrency brokers, trading platforms and other services. Different types of exchanges can be geared toward beginners or experienced users. Crypto.com claims that 100% of all user cryptocurrencies are held offline in cold storage and that it has secured $750 million in crypto insurance. The exchange also says that all online funds in its custodial wallets are generated by the company itself to fund user withdrawals, meaning customer crypto assets are safe offline. US dollar balances in Crypto.com accounts are held by the Metropolitan Commercial Bank and insured by the FDIC.

Coinbase launched the USDC stablecoin with Circle, and it can generate revenue by backing USDC with cash-equivalent investments. This continues to be a great income source for Coinbase, which also recently purchased a stake in Circle. There are a handful of trading strategies that can be profitable, such as https://forexbroker-listing.com/ the Elliott Wave, RSI, Bollinger Bands, etc. Yes, but you will likely need a large amount of upfront investment and a very solid trading strategy. To create supply, bitcoin rewards crypto miners with a set bitcoin amount. To be exact, 6.25 BTC is issued when a miner has successfully mined a single block.

Traders aim to profit from the price movements of these digital assets by analyzing market trends, patterns, and news events. It differs from stock trading in that there are fewer regulations surrounding trading, more assets available to invest in, and it is open 24/7. Crypto CFDs (Contracts for Difference) offer a unique way to trade cryptocurrencies without owning the underlying digital assets. This method involves a contract with a broker to trade the difference in a cryptocurrency’s price from when the contract is opened to when it is closed. It allows for trading on margin, enabling traders to open large positions with a relatively small capital outlay, and offers the flexibility to speculate on both rising and falling markets. However, this also means that gains and losses can be magnified, making understanding leverage and risk management crucial.

Therefore, unless user terms specify otherwise, investors with cryptocurrency assets commingled on a custodial cryptocurrency exchange could potentially lose their funds as unsecured creditors. The escrow mechanism used in the peer-to-peer trading process may be challenging for new users while the comparatively slow trade execution could deter first-time users and active traders. Additionally, the exchange is more targeted at making smaller trades as trading volumes are lower than on centralized global exchanges. While BitMart has a lot to offer for experienced crypto traders, the exchange has received some poor customer feedback over the years.

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.